Gone are the days when transferring money meant standing in long bank queues or waiting for hours for your transaction to process. Welcome to the era of IMPS full form – a revolutionary payment system that has transformed how Indians handle their digital transactions. But what exactly does IMPS stand for, and why has it become such a game-changer in the banking world?

IMPS full form is “Immediate Payment Service” – and trust me, the name says it all! This isn’t just another banking acronym to confuse you; it’s actually your ticket to lightning-fast money transfers that work round the clock, 365 days a year.

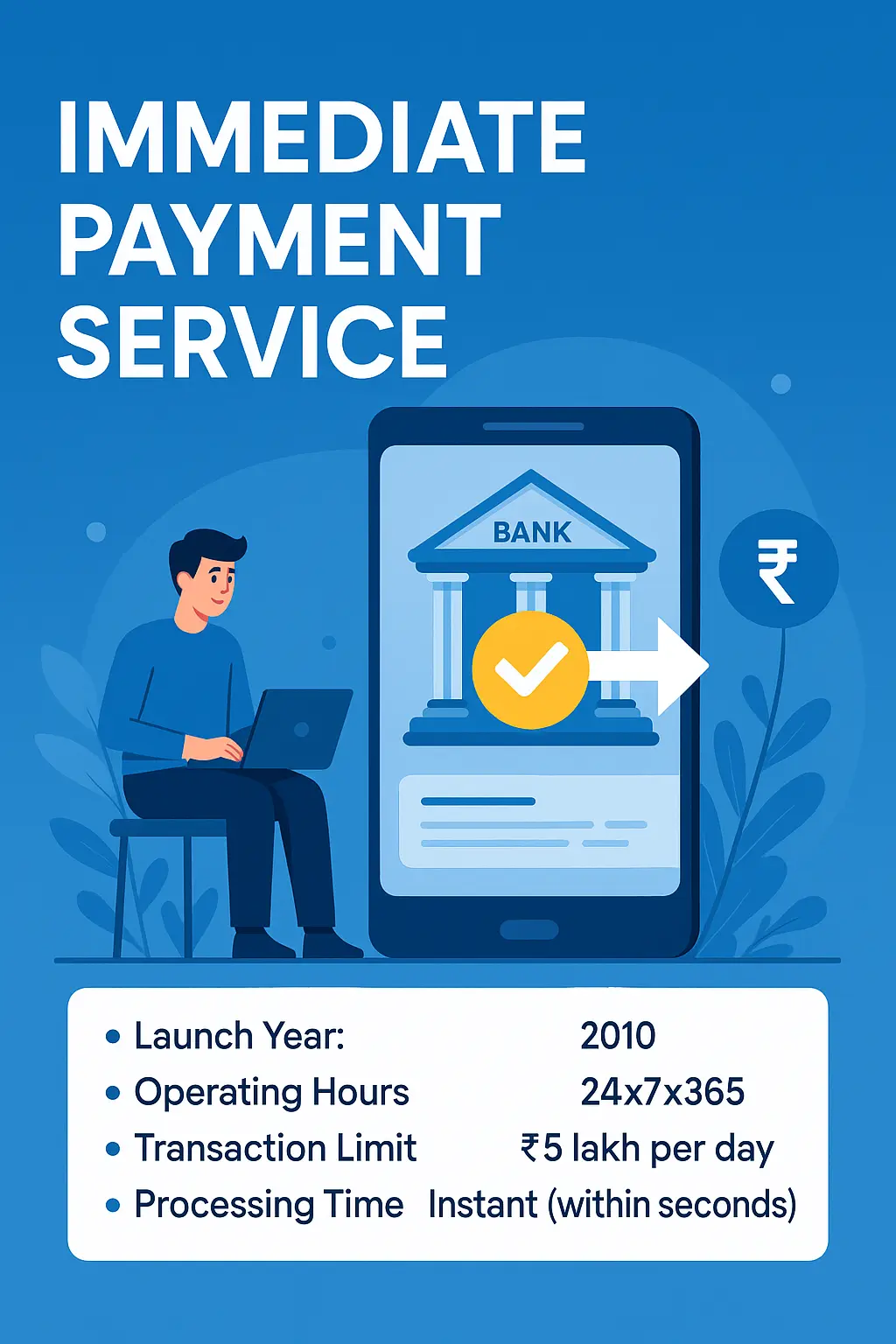

IMPS Statistics Overview

| Parameter | Details |

|---|---|

| Launch Year | 2010 |

| Operating Hours | 24x7x365 |

| Transaction Limit | ₹5 lakh per day |

| Processing Time | Instant (within seconds) |

| Availability | All days including holidays |

| Supported Banks | 200+ banks and financial institutions |

| Monthly Transactions | Over 500 million (as of 2024) |

| Transaction Charges | ₹2-15 depending on amount and bank |

What is IMPS? Breaking Down the Full Form

Let’s start with the basics. IMPS full form in banking stands for “Immediate Payment Service.” It’s a real-time interbank electronic fund transfer system that allows you to send money instantly from one bank account to another, regardless of which bank you’re dealing with.

Think of IMPS full form as the superhero of digital payments – always ready, never sleeping, and incredibly fast. Unlike traditional banking methods that operated only during business hours, IMPS works 24/7, making it perfect for those “Oh no, I forgot to pay the rent!” moments at 2 AM on a Sunday.

The Genesis of IMPS

The National Payments Corporation of India (NPCI) launched IMPS in 2010, and it was like giving wings to the Indian banking system. Before IMPS, if you needed to transfer money urgently outside banking hours, you were pretty much stuck. IMPS full form in banking changed this narrative completely, offering a solution that was both immediate and reliable.

How IMPS Works: The Magic Behind Instant Transfers

Understanding how IMPS full form operates is like understanding how your smartphone connects to the internet – it seems magical, but there’s solid technology behind it.

The Technical Framework

When you initiate an IMPS transaction, your request travels through a centralized switching system operated by NPCI. This system acts like a digital postman, ensuring your money reaches the right destination instantly. The beauty of IMPS full form in banking lies in its real-time gross settlement mechanism, which means transactions are processed individually and immediately.

Multiple Access Channels

What makes IMPS full form even more impressive is its accessibility. You can use IMPS through:

- Mobile banking applications

- Internet banking portals

- SMS-based transactions

- ATM machines

- Bank branches

Expert Insight: According to banking technology specialists, IMPS processes over 95% of transactions within 10 seconds, making it one of the fastest payment systems globally.

IMPS vs. NEFT vs. RTGS: The Ultimate Showdown

When discussing neft rtgs imps full form, it’s crucial to understand how these three systems differ. Let’s break it down in simple terms:

NEFT (National Electronic Funds Transfer)

- Batch processing system

- Works in hourly settlements

- Available during banking hours

- No minimum transaction limit

RTGS (Real Time Gross Settlement)

- Real-time processing

- Minimum transaction limit of ₹2 lakhs

- Available during banking hours only

- Higher charges

IMPS (Our Star Player)

- Real-time processing

- Works 24x7x365

- Transaction limit up to ₹5 lakhs

- Moderate charges

IMPS full form clearly wins when you need immediate transfers without the high minimum limits of RTGS or the time restrictions of NEFT.

Regional Understanding: IMPS Full Form in Different Languages

India’s linguistic diversity means IMPS full form needs to be understood across various languages:

IMPS Full Form in Hindi (हिंदी में IMPS का पूरा नाम)

IMPS full form in Hindi translates to “तत्काल भुगतान सेवा” (Tatkaal Bhugtaan Seva), which literally means “Immediate Payment Service.”

IMPS Full Form in Marathi

IMPS full form in Marathi is “तात्काळ देयक सेवा” (Taatkaal Deyak Seva).

IMPS Full Form in Tamil

IMPS full form in Tamil is “உடனடி கட்டண சேவை” (Udanadi Kattan Sevai).

This multilingual understanding ensures that IMPS full form in banking is accessible to users across different states and linguistic backgrounds.

Bank-Specific IMPS Services

Different banks have branded their IMPS services uniquely. For instance, BOI IMPS full form (Bank of India) offers “BOI Mobile” and “BOI Star Connect” for IMPS transactions, but the underlying IMPS full form remains the same – Immediate Payment Service.

IMPS in the Digital Age: Computer and Technology Integration

IMPS full form in computer terminology refers to how this payment system integrates with various digital platforms. The system uses APIs (Application Programming Interfaces) that allow different software applications to communicate seamlessly with the IMPS network.

Security Features

The digital implementation of IMPS full form includes multiple security layers:

- Two-factor authentication

- Encrypted data transmission

- Transaction monitoring systems

- Fraud detection algorithms

Step-by-Step Guide: How to Use IMPS

Understanding what is IMPS full form is just the beginning. Here’s how you can use it:

Method 1: Mobile Banking

- Log into your mobile banking app

- Select “Transfer Money” or “IMPS”

- Enter beneficiary details (mobile number and MMID or account number and IFSC)

- Enter amount and authenticate

- Receive instant confirmation

Method 2: Internet Banking

- Access your net banking portal

- Navigate to “Fund Transfer” section

- Select IMPS option

- Fill in recipient details

- Complete transaction with OTP verification

Method 3: SMS Banking

Send an SMS in the prescribed format to your bank’s designated number. The exact format varies by bank, but typically includes recipient details and amount.

Benefits of IMPS: Why It’s a Game-Changer

IMPS full form has revolutionized digital payments for several reasons:

1. Round-the-Clock Availability

Unlike traditional banking that follows business hours, IMPS full form in banking works 24/7, including weekends and holidays. Your money doesn’t sleep, and neither does IMPS!

2. Instant Processing

Transactions complete within seconds, making it perfect for emergency situations or time-sensitive payments.

3. Wide Network Coverage

With 200+ participating banks and financial institutions, IMPS full form ensures you can transfer money across different banks seamlessly.

4. Cost-Effective

Transaction charges are reasonable, typically ranging from ₹2 to ₹15 depending on the amount and your bank’s pricing structure.

5. Multiple Access Channels

Whether you prefer mobile apps, internet banking, or even SMS, IMPS full form accommodates various user preferences.

Limitations and Considerations

While IMPS full form is fantastic, it’s not without limitations:

Transaction Limits

- Daily limit of ₹5 lakhs for most banks

- Some banks may have lower limits for different channels

- First-time users might face reduced limits initially

Charges Apply

Unlike UPI which is mostly free, IMPS full form in banking involves nominal charges that vary by bank and transaction amount.

Network Dependency

Being a digital service, IMPS requires stable internet connectivity and bank server availability.

IMPS Success Stories: Real-World Impact

Expert Insight: Banking analysts report that IMPS has facilitated over ₹50 trillion worth of transactions since its inception, showcasing the massive adoption of this IMPS full form service.

Case Study: Emergency Medical Payment

Rajesh from Mumbai needed to transfer ₹50,000 urgently for his father’s medical treatment at 11 PM on a Sunday. Traditional banking would have made him wait until Monday morning, but IMPS full form enabled the instant transfer, potentially saving precious time in a medical emergency.

Small Business Revolution

Local retailers and service providers have embraced IMPS full form in banking for receiving payments from customers, eliminating the need for cash handling and providing instant payment confirmation.

Future of IMPS: What Lies Ahead

The evolution of IMPS full form continues with technological advancements:

Integration with Emerging Technologies

- Blockchain integration for enhanced security

- AI-powered fraud detection systems

- Voice-activated transaction capabilities

- Integration with IoT devices for automated payments

Expanding International Reach

NPCI is working on making IMPS full form available for international transactions, which could revolutionize cross-border payments for Indians.

Common Mistakes to Avoid with IMPS

Understanding IMPS full form also means knowing what not to do:

1. Incorrect Beneficiary Details

Double-check mobile numbers, MMID, account numbers, and IFSC codes before confirming transactions.

2. Ignoring Transaction Limits

Be aware of your bank’s daily and per-transaction limits to avoid failed transfers.

3. Not Keeping Transaction Records

Always save transaction receipts and reference numbers for future reference.

4. Sharing Sensitive Information

Never share your MPIN, OTP, or login credentials with anyone claiming to help with IMPS transactions.

Expert Tips for Optimal IMPS Usage

Expert Insight: Senior banking professionals recommend registering beneficiaries in advance during banking hours to avoid delays during emergency transfers.

Best Practices:

- Regularly update your mobile banking app

- Use strong, unique passwords for banking apps

- Enable transaction alerts via SMS and email

- Familiarize yourself with your bank’s IMPS charges

- Keep backup payment methods ready

IMPS and Financial Inclusion

IMPS full form has played a crucial role in promoting financial inclusion across India. By providing instant payment facilities to users regardless of their location or the time of day, IMPS has democratized access to banking services.

Rural Impact

Farmers can now receive payments for their produce instantly, improving cash flow and reducing dependency on middlemen. Similarly, migrant workers can send money to their families immediately, without waiting for banking hours.

Small Business Empowerment

IMPS full form in banking has enabled small businesses to operate more efficiently by providing instant payment confirmation and reducing the float time between payment initiation and receipt.

Troubleshooting Common IMPS Issues

Even with its efficiency, users sometimes face challenges with IMPS full form:

Transaction Failed but Amount Debited

This is usually a temporary issue where the transaction reversal might take a few hours. Contact your bank if the amount isn’t credited back within 24 hours.

Beneficiary Addition Problems

Ensure you’re using the correct mobile number and MMID combination, or the right account number and IFSC code.

Daily Limit Exceeded

Monitor your daily transaction limits and plan large transfers accordingly, or consider breaking them into smaller amounts.

The Technology Behind IMPS: A Deeper Dive

IMPS full form in computer systems involves sophisticated architecture:

Core Banking Integration

Banks integrate their core banking systems with the NPCI switch through secure APIs, ensuring seamless transaction processing.

Switch Architecture

The NPCI switch acts as the central hub, routing transactions between different banks in real-time while maintaining security and audit trails.

Mobile Money Identifier (MMID)

This 7-digit code uniquely identifies a bank account linked to a mobile number, simplifying the transaction process for users.

Global Perspective: How IMPS Compares Internationally

IMPS full form has positioned India as a leader in instant payment systems globally:

International Comparisons:

- UK’s Faster Payments: Similar concept but limited to specific hours

- Australia’s NPP: Real-time payments but higher transaction costs

- Singapore’s PayNow: QR code-based system with instant transfers

- Brazil’s PIX: 24/7 instant payments launched in 2020, inspired by systems like IMPS

India’s IMPS full form implementation has been studied and replicated by various countries looking to modernize their payment infrastructure.

Environmental Impact of IMPS

The adoption of IMPS full form in banking has contributed to environmental sustainability:

Reduced Paper Usage

Digital transactions eliminate the need for physical cheques, demand drafts, and other paper-based instruments.

Lower Carbon Footprint

Fewer visits to bank branches mean reduced transportation and associated carbon emissions.

Energy Efficiency

Digital processing requires less energy compared to manual transaction processing systems.

IMPS in the Post-Pandemic World

The COVID-19 pandemic accelerated the adoption of IMPS full form as people sought contactless payment methods:

Surge in Usage

Transaction volumes increased by over 40% during 2020-2021, with many first-time users embracing digital payments.

Business Continuity

IMPS full form in banking ensured that essential payments could continue even during lockdowns when bank branches had limited operations.

Healthcare Payments

Instant transfer capabilities became crucial for emergency medical payments and healthcare service settlements.

Regulatory Framework and Compliance

IMPS full form operates under strict regulatory guidelines:

RBI Oversight

The Reserve Bank of India monitors and regulates IMPS operations to ensure system stability and security.

Compliance Requirements

Banks must adhere to KYC (Know Your Customer) norms, AML (Anti-Money Laundering) guidelines, and transaction monitoring requirements.

Consumer Protection

Grievance redressal mechanisms ensure that users have recourse in case of transaction disputes or failures.

Educational Initiatives and Awareness

Understanding what is IMPS full form has been promoted through various educational initiatives:

Financial Literacy Programs

Banks and government agencies conduct workshops to educate users about digital payment systems including IMPS.

Digital India Campaign

IMPS full form has been promoted as part of the broader Digital India initiative to create a cashless economy.

User Guides and Resources

Comprehensive guides in multiple languages help users understand and utilize IMPS services effectively.

Measuring IMPS Success: Key Performance Indicators

The success of IMPS full form can be measured through various metrics:

Volume Metrics:

- Monthly transaction count: 500+ million

- Annual value processed: ₹50+ trillion

- User adoption rate: 300+ million active users

- Bank participation: 200+ financial institutions

Quality Metrics:

- Success rate: >99%

- Average processing time: <10 seconds

- System uptime: >99.9%

- Customer satisfaction: >90%

Integration with Other Payment Systems

IMPS full form in banking doesn’t operate in isolation but integrates with other payment ecosystems:

UPI Integration

Many UPI transactions actually use IMPS rails for processing, leveraging the robust infrastructure.

Wallet Integration

Digital wallets often use IMPS for instant money loading and withdrawals.

E-commerce Integration

Online merchants integrate IMPS for real-time payment confirmation and faster order processing.

Conclusion

Understanding IMPS full form – Immediate Payment Service – opens up a world of convenient, instant, and secure digital payments. From its humble beginnings in 2010 to becoming the backbone of India’s digital payment revolution, IMPS full form in banking has truly transformed how we think about money transfers.

Whether you’re dealing with emergency payments, regular bill settlements, or business transactions, IMPS full form provides the reliability and speed that modern financial life demands. Its 24×7 availability, wide network coverage, and reasonable charges make it an indispensable tool for anyone navigating India’s digital economy.

The beauty of IMPS full form lies not just in its technical capabilities, but in its democratizing effect on financial services. It has made instant money transfers accessible to everyone, from urban professionals to rural farmers, contributing significantly to India’s journey toward a cashless society.

As we look to the future, IMPS full form will continue evolving, integrating with new technologies and expanding its reach. For now, it stands as a testament to India’s innovation in financial technology and its commitment to inclusive, efficient banking services.

Remember, every time you make an instant transfer, you’re experiencing the power of IMPS full form – a system that has revolutionized banking not just in India, but has inspired similar innovations worldwide.

Frequently Asked Questions (FAQs)

Q1: What is the full form of IMPS?

A: IMPS full form is “Immediate Payment Service.” It’s an instant, real-time interbank electronic fund transfer system that operates 24x7x365.

Q2: How is IMPS different from NEFT and RTGS?

A: Unlike NEFT (batch processing) and RTGS (high minimum limits and banking hours only), IMPS full form offers instant transfers 24/7 with flexible transaction limits up to ₹5 lakhs.

Q3: What is IMPS full form in banking terms?

A: IMPS full form in banking refers to the Immediate Payment Service that enables real-time fund transfers between bank accounts across different banks in India.

Q4: Is IMPS available 24/7?

A: Yes, IMPS full form services are available 24 hours a day, 7 days a week, 365 days a year, including weekends and holidays.

Q5: What are the transaction limits for IMPS?

A: The maximum daily transaction limit for IMPS full form is typically ₹5 lakhs, though individual banks may set lower limits for different channels.

📚 Curious about other banking terms? Don’t miss our guide on NEFT full form and how it compares to IMPS and RTGS! 🔍